February 24, 2023

Author: Roy Tse, Chief Risk Officer

Counterparty Risk:

The Celsius Bankruptcy

From Madoff to the FTX scandal, history repeats itself as a lack of transparency and operational controls creates a breeding ground for greed and fraud.

The recently released 689-page Celsius bankruptcy examiner’s report confirmed what we already knew: Unrealistic lofty promises were made, driven by greed, and inevitably when the situation became unsustainable, customer assets were used to cover up losses, made possible by lack of transparency and operational controls.

Not Just a Crypto Issue

As media outlets and industry experts have speculated over the past months, the Celsius collapse was a confluence of fraud, inept counterparty risk management, misappropriation of customer funds, and a lack of operational controls and oversight. As some of the same media outlets and industry experts have also incorrectly pointed out, the factors above that led to Celsius’ demise are not specific to cryptocurrencies, but rather an often-repeated systemic failure, particularly in nascent industries (such as crypto) where regulation may be slow to catch up to the industry’s growth. It’s worth reiterating that these systemic failures are not crypto specific but are as old as the financial system itself.

Like other notable financial failings such as Madoff, Long-term Capital Management (LTCM), Lehman Brothers, FTX, and Genesis Global, to name a few, the lack of true transparency, along with the lack of operational and compliance risk controls and guardrails, are the true causes of failure. The basic tenet of “trust but verify” in the above cases was not followed. Throughout the years, these failures were the result of institutions over-trusting their counterparties and were failures of process, unrelated to crypto.

Madoff set the stage for additional risk controls. Prior to Madoff, hedge funds and private equity vehicles were largely not scrutinized. Fund accounting, which drives manager compensation in the form of incentive fees, was typically calculated and managed internally by the same people who were paid the incentive fees. Furthermore, in the case of Madoff, a multi-billion-dollar fund, the fund auditors were a one-person firm located in a strip mall in Long Island, NY. Post-Madoff, a reputable third-party fund administrator is a prerequisite for all existing and newly created funds and such practice has become an industry norm. The SEC has also stepped up its monitoring, instituting more comprehensive reviews of investment advisors.

The Real Enemy is Lack of Controls

Setting aside the actual cause of Celsius' situation for a moment and focusing on the effect of Celsius misusing and losing customer and investor capital, the glaring reason why customer funds were misappropriated is the lack of proper controls.

Hindsight is always 20/20. It is apparent now that Celsius had no controls in place to ensure that customer funds and assets could not be co-mingled with internal Celsius treasury, nor could those customer assets be posted as collateral or re-hypothecated for Celsius' borrowing activities.

Both of those control failures happened: customer assets were moved to Celsius accounts and customer assets were posted as collateral.

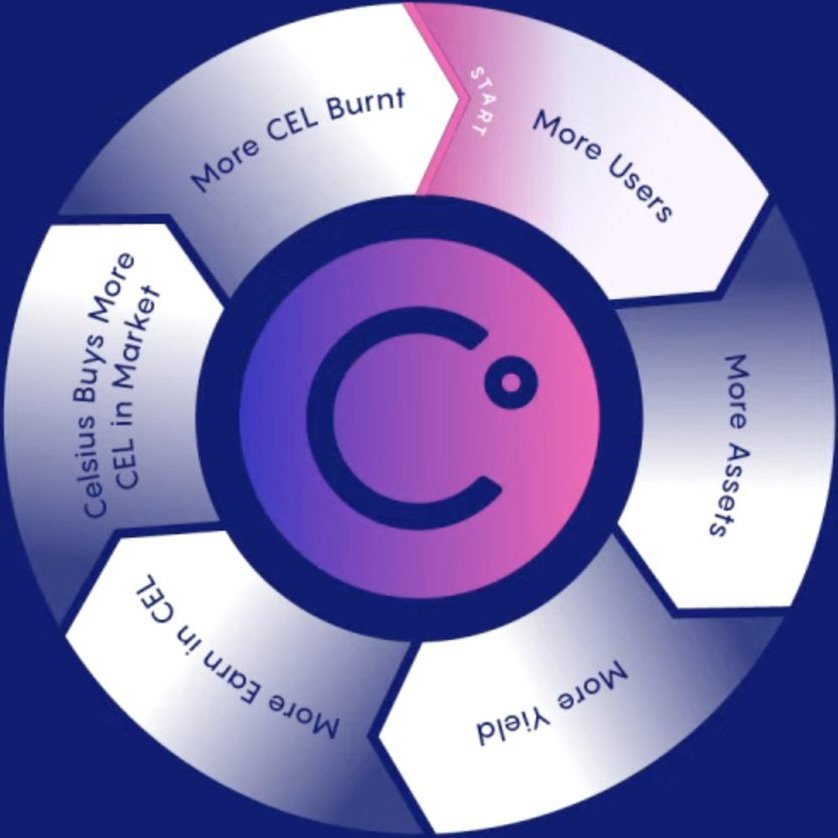

Celsius needed funds to buy back its internal platform token CEL. When internal coffers ran dry, Celsius posted customer deposits and assets as collateral with counterparties. Celsius, using freshly borrowed funds, continued its buyback of CEL. Without a true “flywheel”[1], a term Celsius coined (no pun intended) to describe its theory of a self-perpetuating CEL ecosystem where usage creates demand, thereby increasing CEL coin price, the CEL ecosystem was doomed from the start. And with no collateral and assets supporting CEL beyond Celsius' sizeable liabilities, CEL, whose valuation depended on Celsius’ financial condition, was arguably worth zero.

The Celsius Flywheel:

CEL Price and the Downfall of Celsius:

Some Basic Controls May Have Mitigated the Damage

Since Celsius' collapse less than a year ago, FTX and Genesis Global have unfortunately shown that we have not yet learned our lesson. While there are distinct differences among the three bankruptcies, the common theme is the lack of controls which allowed customer funds to be misappropriated. Again, not minimizing the cause of these failures, but the risk of the effect could have been mitigated.

For our own holdings here at Samara Alpha, we only partner with counterparties who have passed our rigorous operational due diligence process, which includes asking and receiving satisfactory responses to questions such as:

Do the entities that hold your customer assets have independent authorized signatories that are not employees of an affiliated entity?

Do your borrowing agreements allow customer assets to be posted as collateral for your borrowing activities?

Are customer assets held in separate wallets than that of the company, with customer approval required for asset transfers?

The questions above are a small subset of what we ask our partners. To truly eliminate counterparty risk is almost impossible; however, with prudent oversight and carefully designed process, we believe one can mitigate or avoid non-systemic failures that lead to bankruptcies.

In the case of FTX, from what we know thus far, it appears that customer assets were also misappropriated and transferred to either FTX’s accounts or accounts of FTX’s affiliates or closely connected companies. For any customers and business partners of FTX or Celsius, asking the above questions and verifying the control process around the flow of funds could have revealed control deficiencies.

Be Vigilant About Token Valuation and “Wrong-Way” Risk

It is of course also worth mentioning that proof of collateral or reserves is a key issue in the FTX scandal. Leading up to FTX’s collapse, FTX’s native token FTT was widely posted as collateral across the crypto economy at FTX’s customers’ accounts. These institutions, mostly large and established that should have known better, trusted the self-reported size of FTT’s reserves without a third-party independent valuation. As FTX’s leveraged balance sheet collapsed due to its bad investments, customers holding FTT as collateral found themselves with worthless tokens.

Changpeng Zao (CZ), CEO of Binance, FTX’s larger and main competitor prior to FTX’s collapse, is wary of “wrong-way” risk. He has historically been critical of posting a self-created token as collateral and has not done so with Binance’s own Binance Coin. After the FTX scandal, CZ has adopted a proof of collateral concept into Binance Coin with the hopes of increasing transparency in Binance Coin’s reserves to assuage market fears post-FTX. Proof of collateral and ultimately proof of reserves is certainly a welcome measure that we hope will become industry standard for future tokens.

Repeatedly Update History to Avoid Repeating History

As with all things, change is the only constant. Under favorable market conditions, the next Celsius may look to be in good financial health. As with any nascent and competitive industry, crypto’s inherent volatility could change a company’s financial picture and prospects very quickly. Here at Samara Alpha, we perform scheduled periodic updates on our operational due diligence of our partners. The updated information is re-reviewed and analyzed for any warning signs of potential issues.

Stronger Regulation Minimizes Systemic Risk

On February 15th, 2023, the SEC proposed to add a “Safeguarding Rule” that would require advisers with custody of client assets to maintain those assets with a qualified SEC-registered custodian. While it is not yet clear whether crypto exchanges would fall under this rule, traditional financial companies that also manage bonds and equities have been partnering with qualified custodians, such as Fidelity, State Street, and Nasdaq, for many years. We at Samara Alpha welcome more qualified custodians emerging in the crypto industry and are watching this proposed amendment develop as it moves through the comment period.

As regulation catches up to the crypto industry’s growth, counterparty risk and large-scale systemic failures are bound to happen. We are strong supporters of transparency and regulation to create a stable, safe ecosystem that can scale. With that said, while we look forward to improved regulations, our fiduciary responsibility to our investors is our top priority and we will continue to diligence our partners and investment selections to protect our investors’ capital.

[1] Celsius, Celsius AMA 21st January 2022