Graphing Digital Assets

Month in Review — July 2024

Bitcoin’s Rollercoaster Ride

The price of bitcoin was notably turbulent in July. While bitcoin gained a modest 3.10% in the month, it took a roundabout journey to get there, dropping to lows below $55,000 and briefly surpassing highs of $69,000 during the month. Several factors contributed to this volatility (top graph).

1) Bitcoin Sell-Offs (and Fear Thereof): ↓

Selling pressure, both anticipated and actual, drove prices down at the beginning of the month. On June 20th, the German government began selling its stockpile of 50,000 BTC, which had been seized by Germany’s Federal Criminal Police Office. This sell-off persisted until July 13th, when Germany’s stockpile reached zero. Mt. Gox payouts added to the selling pressure, as well as bitcoin miners continuing to offload their bitcoin reserves since April’s halving.

2) The Prospect of Legislative Support: ↑

Bitcoin’s price surged following the assassination attempt on former President Donald J. Trump on July 13th. Given Trump’s pro-crypto stance, the increased odds of his winning the election had given investors hope for a crypto-friendly future.

Positive sentiment continued to increase leading up to and following the industry’s highly-anticipated Bitcoin Nashville conference at the end of the month. Industry leaders and advocates joined the approximately 20,000 attendees, culminating in a keynote speech by Donald J. Trump. The promise of Bitcoin-friendly legislation included Senator Cynthia Lummis’ announcement of a bill to make bitcoin a U.S. strategic reserve, particularly noteworthy as the U.S. Government’s 210,000+ seized BTC is the largest stockpile of any government (bottom graph).

3) Macro and Geopolitical Forces: ↓

Bitcoin’s price was pushed down at the close of the month in response to macroeconomic factors. Fear & Greed indices plunged into ”extreme fear” as investors reacted to: (1) a disappointing jobs report that pointed to a weakening U.S. economy; (2) Bank of Japan increasing interest rates which led to the unwinding of yen carry trades; and (3) ongoing tensions in the Middle East.

This rollercoaster ride may point to bitcoin’s increasing sensitivity to broader market movements, signaling its ongoing maturation and deeper integration into the global financial system. Despite July’s volatility, Bitcoin’s evolving role in political and financial landscapes continues to pave the way for broader acceptance and institutional adoption.

Source for BTC Daily Open Price: Coinbase. Source for holdings: BitcoinTreasuries.net. Data as of July 31, 2024.

Circle’s Compliance Paying Off

In January, we reported on the growth of stablecoins. We also noted that these assets were to be the first to be regulated under Europe’s Markets in Crypto Assets (MiCA) regulations, which took effect on June 30th for stablecoins. Under the legislation, algorithmic stablecoins are banned, and asset-backed stablecoins must obtain an Electronic Money Institution (EMI) license from the EU and comply with strict rules.

In response to these new regulations, several European exchanges preemptively delisted non-compliant stablecoins. Circle, however, seized the opportunity and, on July 1st, emerged as the first global stablecoin issuer to achieve compliance with the MiCA regulatory framework. Of the top ten stablecoins by market cap, Circle’s USDC is the only one in compliance with the new EU rules. EURC, Circle’s euro-backed stablecoin, is also MiCA-compliant.

This strategic positioning paid off. According to CCData, USDC's trading volume surged by an 48.1% in July (top graph), and its stablecoin market share increased from 19.81% to 20.21%, representing a 5.36% rise in market capitalization. EURC also saw a notable increase of 4.05% in its market capitalization.

While Tether's USDT also experienced growth, with a 1.61% increase in market capitalization, its dominance waned, its share dipping from 69.94% to 69.82%. Overall, stablecoins continued their upward trajectory, with market cap growing by 2.11% in July, reaching its highest levels since May 2022 (bottom graph).

This initial phase of digital asset regulation underscores how well-structured regulatory frameworks can benefit compliant entities and support industry growth. As the remaining MiCA regulations take effect on December 30, 2024, and as similar regulatory measures are adopted globally, we expect a continued positive trend that will promote the expansion of compliant players and the growth of the industry as a whole.

Sources: CCData Stablecoins & CBDCS Report, July 2024 (top graph); DeFiLlama as of July 31, 2024 (bottom graph).

Launching US Spot ETH ETFs

July marked a historic month for both ETH and digital asset ETP issuers in the United States, as nine spot ether exchange-traded funds (ETFs) began trading on July 23rd. Yet ETH’s price ended the month down -5.84%. There are mixed views on the success of these ETFs and expectations for their future inflows.

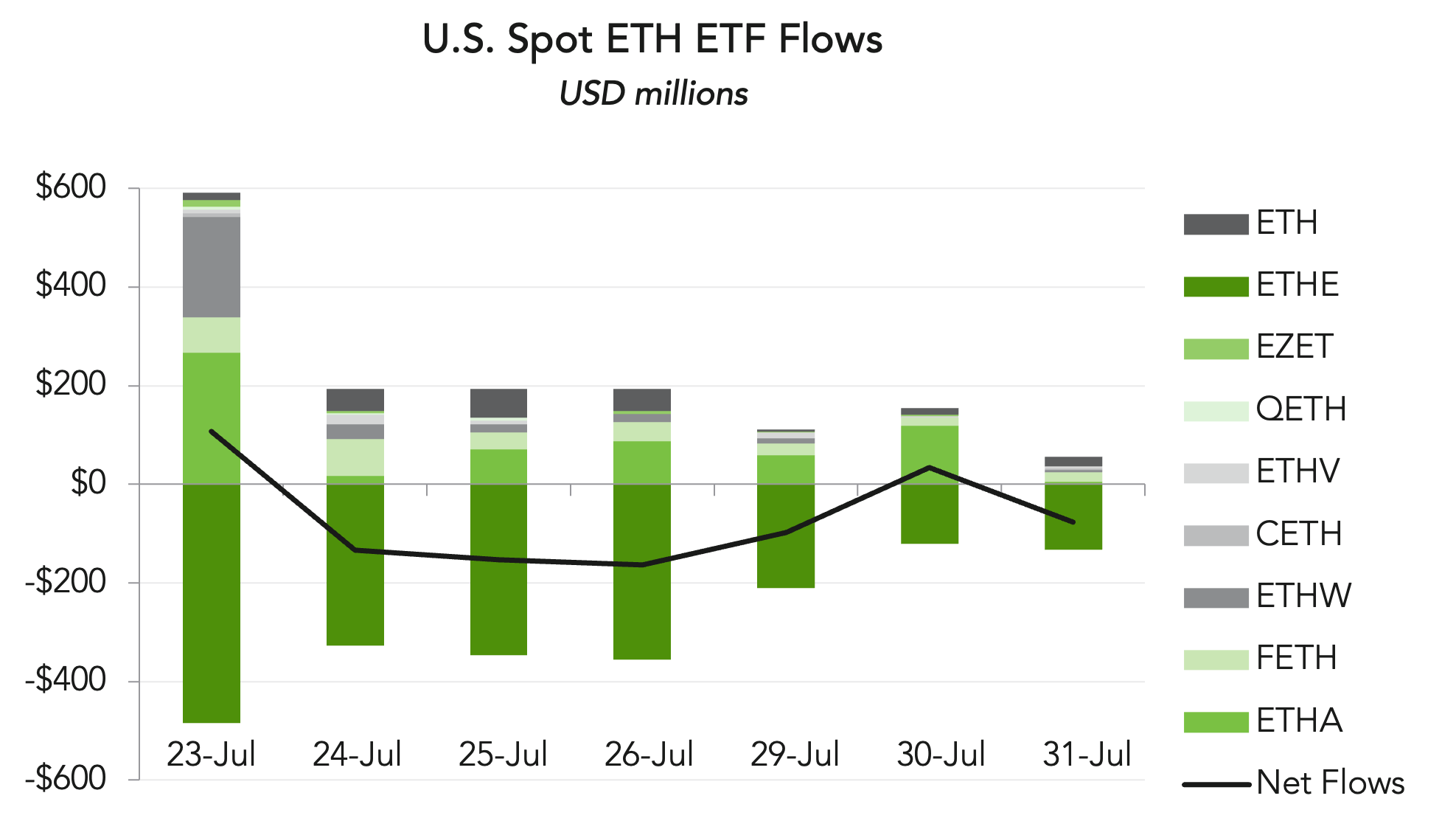

In the first seven days of trading, spot ETH ETFs saw net outflows of $483.6 million. This included $1.494 billion in inflows, driven mostly by BlackRock’s ETHA at $623.2 million, and outflows of $1.977 billion from Grayscale’s ETHE (left graph). The ETFs saw positive net flows on days 1 and 6 of trading, with daily outflows trending downward towards month-end.

At the time of the launch, the Grayscale Ethereum Trust, holding roughly $9.2 billion in assets, was converted into an ETF (ETHE), with fees of 2.5%. The fees for the other eight ETFs range from 0.19% to 0.25%, making it likely that a significant portion of the flows came from investors rotating their money out of ETHE into other products with lower fees.

Critics argue the launch was a disappointment compared to US spot bitcoin ETFs, which saw net inflows of $1.089 billion in their first seven days of trading, representing a greater ratio of inflows to outflows during this initial trading period.

The lackluster ETH ETF launch may be attributable to lower investor demand compared to spot BTC ETFs. According to market capitalization dominance by token over time, there has historically been significantly more demand for BTC than ETH, with bitcoin’s market capitalization typically more than 3x than that of ether (right graph). Additionally, while many investors view bitcoin as an attractive investment due to its store of value, a crucial part of ETH’s value comes from its staking capabilities, which the ETFs do not have, potentially dampening investor appetite for ETH ETFs.

Yet optimists remain undeterred, maintaining the two products should not be compared as they are based on different assets and launched in different market environments under different circumstances.

According to Chris Rhine, Galaxy’s Head of Liquid Active Strategies and former Blackrock VP, the timing of the ETH ETF launch was a surprise to issuers, resulting in a quick turnaround to submit documents to the SEC. Consequently, unlike for BTC ETFs, most firms did not have marketing in place for U.S. spot ether ETFs and therefore did not garner much media attention. He expects near-term flows to struggle due to outflows from ETHE but anticipates positive flows will eventually dominate.

Katalin Tischhauser, Head of Investment Research at Sygnum Bank and a former executive at Goldman Sachs, predicts, “With Ethereum’s market capitalization a third of Bitcoin’s, we expect the relative inflows to be in the 15-35% range versus Bitcoin, with a resulting forecast of $5 to $10 billion in the first year.”

Despite a challenging launch and mixed early performance, the introduction of U.S. spot ETH ETFs marks a significant step in the evolution of digital asset investment products. While initial outflows suggest some investor hesitation, particularly in comparison to bitcoin ETFs, the long-term outlook remains cautiously optimistic. As the market matures and awareness grows, ETH ETFs could eventually carve out a substantial niche in the broader investment landscape.

Source: Farside Investors Ethereum ETF Flow as of July 31, 2024.

Source: TradingView as of July 31, 2024.