Graphing Digital Assets

Month in Review — October 2023

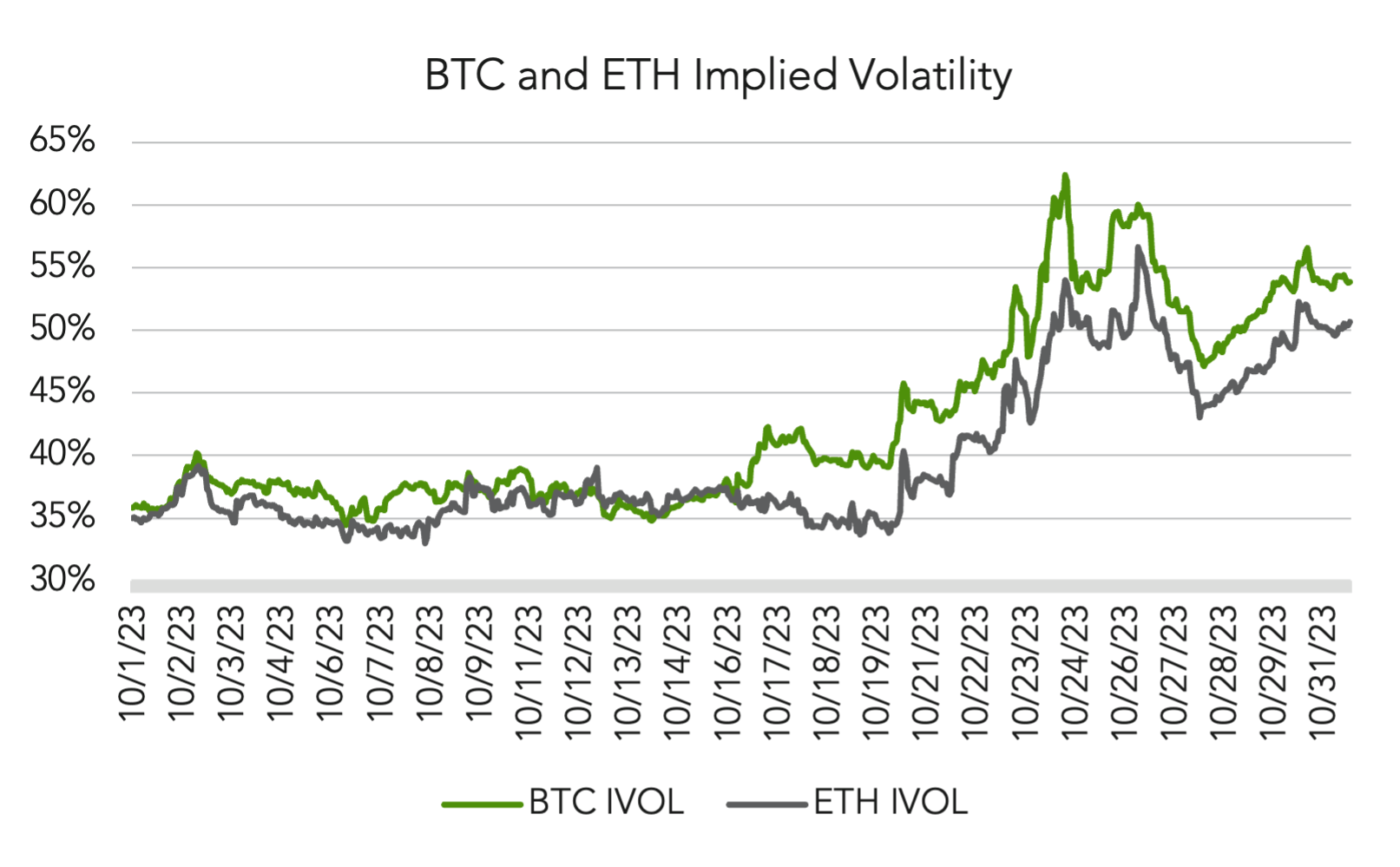

BTC Implied Volatility

Bitcoin made headlines in October as it reached $35,000 for the first time since May 2022.

The implied volatility of BTC, typically below that of ETH, surpassed ETH and has maintained this dominance throughout the recent surge. The implied volatility graph shows BTC’s curve riding on top of ETH’s for most of the month, reflecting lack of liquidity and price action in altcoins.

The BTC volatility cone from October 24th shows an inverted term structure for the Deribit ATM IV, typically indicating that options with shorter maturities have higher implied volatilities than options with longer maturities. This often translates into hedging price risk for shorts in the market with near-term options, while leaving long-dated options alone. We predicted that the term structure for BTC’s implied volatility would flatten following this recent spike, which it did shortly after.

BTC Price Movement Triggers

In light of BTC’s October spike, we examined the effect of an increase in BTC price, along with the potential approval of a spot bitcoin ETF, on Grayscale’s GBTC.

GBTC has traded at a discount that has been widening from February 2021 until December 2022. Yet this discount significantly narrowed in 2023, down to approximately -13.7% at the end of October, in line with BTC price increases. This alignment suggests that GBTC price is more sensitive to spot bitcoin ETF approval than BTC spot price.

As highlighted in the graph, we observe the following:

Jun 15: BlackRock filed with the SEC for a spot bitcoin ETF, prompting a wave of applications to be filed by other firms.

Aug 29: The U.S. Court of Appeals for the D.C. Circuit ruled that the SEC was wrong to reject Grayscale’s application to convert its GBTC to a spot bitcoin ETF.

Sep 26: The SEC, ahead of its decision deadline, postponed its ruling on ARK Invest 21Shares’ spot bitcoin ETF until January 10, 2024, leading to speculation about potential concurrent approvals of multiple spot bitcoin ETFs.

Oct 13 / Oct 16: The SEC missed the deadline to challenge the decision of the D.C. Court of Appeals and will have to reconsider Grayscale’s application. Three days later, the market reacted to Cointelegraph erroneously announcing that the spot bitcoin ETF had been approved.

As the hard deadlines for the SEC to give their decision on multiple spot bitcoin ETF applications rapidly approach, we expect GBTC’s discount to NAV to continue to narrow.

Spot Bitcoin ETF Inflows

In October, many of the spot Bitcoin ETF applications under review by the SEC were amended and resubmitted by the companies that initially filed them, including Ark Invest, Bitwise, BlackRock, Fidelity, Invesco, VanEck, Valkyrie, and Grayscale.

The first final deadline for the SEC to reach a decision on a spot bitcoin ETF (ARK 21Shares Bitcoin ETF) is set for January 10, with subsequent deadlines set between March and May 2024. This timeline suggests the SEC is on track to approve a spot bitcoin ETF before Q2 2024.

Galaxy Research estimates bitcoin ETF inflows of $14.4B in the first year, growing to $26.5B and $38.6B in years 2 and 3, respectively, with exponential growth in BTC price and market cap. NYDIG projects an $18.0B inflow and BTC price of just over $35k, reflecting their belief that the market has already priced in a spot bitcoin ETF rally.

If approved, these projected inflows, combined with the anticipated Bitcoin halving event in April 2024, has the potential to trigger substantial BTC price movements.

Yet there are skeptics. In a July report, JP Morgan also pointed out that inflows into Bitcoin funds overall, including futures based and physically backed funds, had remained steady since Q2 2021, failing to benefit from investor outflows from gold ETFs, a relevant observation given the comparison of bitcoin spot ETFs to gold ETFs.

Skeptics aside, the market has thus far reacted positively to spot bitcoin ETF news. It remains to be seen if this trend will continue once the first spot bitcoin ETF is approved in the US, or if all positive momentum will have been priced in by then.

Cumulative Flows into All Bitcoin Funds and Gold ETF Holdings

Source: JP Morgan as of July 6, 2023