Crypto-linked Autocalls

How digital asset investors take advantage of structured products

Nov 15, 2023During periods of risk aversion, government bonds have historically served as a reliable shelter for investors. The global central bank has taken a series of measures to counter high inflation by gradually increasing its benchmark interest rate. The annualized yield on short-term U.S. Treasury bills has recently exceeded 5.25%, while the 10-year treasury bond yield is approaching 5.0%. This current interest rate environment provides an appealing opportunity for investors with US dollars to deploy.

However, investors in digital assets, which are non-yielding, are left sitting on the sidelines. Samara maintains a constructive view on digital assets in the current recovery phase and therefore prefers not to overwrite large portions of markets through the sale of out-of-the-money (OTM) call options, keeping the upside exposure. Yet, we believe that early cycles are good candidates for selectively selling away upside and harvesting volatility to generate yield, or to generate additional financing to redeploy in upside strategies in other parts of the cryptocurrency market.

Structured Products Offer a Solution for Digital Asset Investors

The next institutional adoption of digital assets will inevitably include the advent of structured products, financial instruments designed for savings or investment purposes, where the potential returns are linked to an underlying asset or a portfolio of securities. [1]

Structured products offer predetermined returns in exchange for predefined risks; are highly customizable and can be tailored to accommodate varying market conditions and associated risks; can be personalized investment solutions with risk management and downside protection; and capitalize on asset volatility to generate income and effectively diversify investment portfolios in a cost-efficient manner.

During the last crypto bull market, we saw promising growth of such crypto-linked structured products, especially in Asia and Europe, in both on-chain and off-chain formats. Many crypto broker-dealers also offer them through their over-the-counter (OTC) desks.

Here we introduce a popular structured product, namely, autocalls. First, we highlight various type of autocalls, including the Autocall Reverse Convertible, the Classic or Athena Autocall, the Autocall Phoenix Memory, and the Twin-Win Autocall, and describe their respective structures. Then, we analyze returns and risk factors, and perform sensitivity analyses through several numerical exercises using a simple Heston model.

Crypto-linked Autocalls

An autocall is a structured financial product that provides investors with a combination of principal protection and potential income through coupon payments. The most observed payoffs associated with autocall mechanisms encompass capital-guaranteed notes and barrier reverse convertibles. In traditional finance, autocalls exhibit a standard maturity period of three years. In contrast, autocalls linked to cryptocurrencies tend to mature within six months, primarily due to the lack of liquidity at the long end of the volatility surface, limiting dealers’ ability to effectively hedge and price long-dated notes.

Autocall Reverse Convertible

An Autocall Reverse Convertible is a structured investment product that combines elements of a reverse convertible with an autocall feature (Exhibits 1 and 2).

Exhibit 1: Reverse Convertible Payoff

Exhibit 2: Reverse Convertible Sample Terms

Here’s a breakdown of key features:

Reverse convertible: A reverse convertible is a structured investment product that typically generates fixed coupon payments for the investor at maturity, like a bond. These coupons are typically paid regardless of the underlying asset's performance during the investment period.

Fixed coupon payments: The Autocall Reverse Convertible, like a reverse convertible, generates fixed coupon payments for the investor. These coupon payments are made at specific intervals or at maturity, as specified in the product's terms.

European barrier level: The product includes a barrier level for the underlying asset. This barrier level is a specified threshold and plays a crucial role in determining the product's performance at maturity.

Capital repayment: At maturity, if the underlying asset's performance is above the barrier level, the product pays back the investor's capital. This means that the investor receives their initial investment amount in full.

Performance-based capital repayment: If, at maturity, the underlying asset's performance is below the barrier level, the product repays the investor's capital, but it may be reduced by the underlying performance loss. In other words, the investor may not receive the full initial investment amount if the underlying asset has experienced a loss.

Autocall feature: The "autocall" feature means that there may be specific observation or autocall dates during the investment period. If, on any of these dates, certain conditions are met (e.g., the underlying asset's performance reaches a specified level), the product may be called early. In such a case, the investor typically receives the fixed coupon payments and the principal, and the investment is terminated before maturity.

In summary, if the underlying asset's performance is above the barrier level at maturity, the investor receives their capital in full. If the underlying asset's performance is below the barrier level, the capital repayment may be reduced by the underlying performance loss. Additionally, the product may be called early on specific autocall dates, providing the investor with the fixed coupons and the principal amount.

Classic or Athena Autocall

An Athena Autocall is a structured investment product that provides a balance between principal protection and the potential for enhanced returns based on the underlying asset's performance (Exhibits 3 and 4).

Exhibit 3: Athena Autocall Payoff

Exhibit 4: Athena Autocall Sample Terms

Key features include:

Principal protection: The product offers automatic redemption of the principal amount, which means that investors will receive their initial investment back if certain conditions are met.

Escalating coupon: The Athena Autocall pays an escalating coupon, often denoted as "𝑡 * coupon." This means that the coupon rate may increase over time, typically with each autocall date.

Autocall dates: Specific dates at which the product's performance is evaluated, typically set monthly. If the underlying asset's performance meets certain criteria on an autocall date, the product may be called, resulting in the return of the principal and any accrued coupons to the investor.

Underlying asset: The performance of the Athena Autocall is tied to the performance of an underlying asset, CME bitcoin Futures or CME ether Futures.

Autocall trigger level: The product specifies a trigger level for the underlying asset. If the underlying asset's value is above this trigger level on an autocall date, the product may be called, and the investor receives the principal and any accrued coupons. Typically, it is 100% of the reference price of the underlying asset at the pricing date.

European barrier level: If the underlying asset's value falls below a specified barrier level at maturity, and the product is not called earlier, the investor may not receive the principal protection, and returns will be based on the performance of the underlying asset at that point. Typically, it is 100% of the reference price of the underlying asset at the pricing date.

In summary, if the underlying asset performs well and meets the trigger level on any of the autocall dates, the product may be redeemed early, providing the investor with their principal and any accrued coupons. If not, the product's performance at maturity will depend on whether the underlying asset's value has fallen below the barrier level.

Autocall Phoenix Memory

The Autocall Phoenix Memory is a structured financial product that combines an Athena Autocall feature with a Memory Coupon function (Exhibit 5). The note pays the early redemption amount if an early redemption event has been triggered. If no early redemption event has been triggered, the note pays a final redemption amount at the maturity date. The note also pays coupons, depending on the performance of the underlying basket.

Exhibit 5: Autocall Phoenix Memory Sample Terms

Key features include:

Autocall feature: Like the Athena Autocall, the Autocall Phoenix Memory includes an autocall feature.

European barrier level: The product specifies a barrier level for the underlying asset. If, at an observation date, the underlying asset's price falls below this barrier level, it may trigger a different outcome at maturity.

Memory coupon barrier: This is a unique feature of the Autocall Phoenix Memory. If, on an observation date (which may include the redemption date), the underlying asset's price closes at or above a specified coupon barrier, the product pays a coupon. Importantly, it also pays all the previous coupons that were unpaid. This means that if the underlying asset's price reaches or exceeds the coupon barrier, it accumulates and pays out all previously unpaid coupons, enhancing the investor's potential returns. Unlike Athena, coupon payments here are path-dependent.

Maturity: If, at maturity, the underlying asset's price is below the barrier level, the product delivers the underlying performance only. This means that the investor's returns will depend on the final performance of the underlying asset at the end of the product's term.

In summary, the Autocall Phoenix Memory offers the potential for enhanced returns through the accumulation of unpaid coupons if the underlying asset's price closes at or above a specified coupon barrier on observation dates. If the underlying asset's price is below the barrier level at maturity, the investor's returns will be based on the performance of the underlying asset. This product is designed to provide a balance between potential enhanced returns and the risk of receiving underlying asset performance if certain conditions are not met.

Twin-Win Autocall

The Twin-Win Autocall with Memory Coupon is another structured investment product that combines certain features found in the Autocall Phoenix Memory with some variations (Exhibits 6 and 7). It is structured with a down-and-in put to capture the absolute performance of the underlying at maturity. The name Twin-Wins comes from the fact that this note enables the holder to get a participation in both the upside and the downside movements of the underlying asset if no knock-in event occurred.

Exhibit 6: Twin-Win Autocall Payoff

Exhibit 7: Twin-Win Autocall Sample Terms

Notable features include:

Memory coupon: This product offers a memory coupon function, similar to the one in the Autocall Phoenix Memory. If, on an observation date (which may include the redemption date), the underlying asset's price closes at or above a specified coupon barrier, the product pays a coupon. Importantly, it also pays all the previous coupons that were unpaid, accumulating the unpaid coupons over time.

Automatic redemption: The Twin-Win Autocall with Memory Coupon includes an automatic redemption feature, which means that the product has specific observation or autocall dates. If certain conditions are met on these dates, the product may be automatically redeemed, providing the investor with their principal and any accrued coupons.

Maturity: At maturity, the product's performance depends on the absolute performance of the underlying asset and whether it is above or below the barrier level. If the underlying asset's price is above the barrier level, the product pays the absolute performance of the underlying asset, meaning the investor will receive returns based on the underlying asset's performance.

European barrier level: The barrier level is a specified level of the underlying asset's price. If, at any point, the underlying asset's price falls below this barrier level, it may affect the product's performance, particularly at maturity.

In summary, if the underlying asset's price is above the barrier level, the investor receives returns based on the underlying asset's absolute performance, and any unpaid coupons accumulate through the memory coupon function. If the barrier level is not met, the investor's returns are based on the underlying performance.

The Structure

Crypto-linked autocalls represent path-dependent structured financial instruments. They exhibit dependency on the historical price movements of the underlying asset, which can be a specific cryptocurrency pair or a basket of various crypto assets. Autocalls are designed to enhance yields, offering more attractive coupon rates compared to conventional debt instruments. This enhanced coupon rate is achieved through a combination of the following components:

Holding an issuer's debt security, which exposes the investor to the credit risk associated with the issuer.

Owning a series of digital call options, which serve the dual purpose of generating periodic coupon payments and the potential for early redemption (autocall).

Writing a put option in exchange for a premium, introducing a level of risk in the form of potential capital loss.

In practice, the embedded call options are "knocked out" if the price of the underlying asset rises above a predetermined trigger barrier, leading to their redemption. Conversely, the embedded put option is "knocked in" when the underlying asset's price falls below a predefined protection barrier, activating the put option.

A put option is a financial contract that grants the holder the right (but not the obligation) to sell an asset at a specified strike price on or before a specified expiration date. By writing a put option, autocall investors assume the risk of incurring partial capital loss, which is contingent on the relationship between the underlying asset's price and the strike price. The knock-in barrier for the put option is typically monitored more frequently and set at a lower level compared to the initial spot price. For example, it might be set at 70% of the strike price.

A crypto-linked autocall product has a maturity of less than two years, with observation points occurring at quarterly or semiannual intervals. If, at a particular observation date, the price of the underlying crypto asset surpasses a predetermined upside barrier (knock-out level, e.g., 100% of the strike price), the product is autocalled. This means it is automatically redeemed without reaching maturity, returning the investor's principal and providing a coupon payment.

The embedded put option comes with a knock-in feature, which is usually monitored daily and set at a lower level compared to the initial spot price (strike price). For instance, it might be set at 70% of the strike price. If, at a specific observation date, the price of the underlying crypto asset exceeds a designated upside barrier (knock-out level, e.g., 100% of the strike price), the product is autocalled, automatically redeeming and returning the principal amount along with the coupon, without waiting until maturity.

Risk Factors

Numerous economic and market determinants exert influence on the valuation of crypto-linked autocalls. These factors encompass, but are not limited to, the following:

The prevailing price of the underlying cryptocurrency asset on a given day, often regarded as the foremost determinant of valuation;

The implied volatility in the underlying cryptocurrency asset, as it significantly impacts the potential returns and risks associated with autocalls;

The duration to maturity, representing the length of time an investor's capital remains committed to the instrument;

The prevailing interest and yield rates within the broader financial market, which can affect the relative attractiveness of crypto-linked autocalls compared to other investment options; and

The creditworthiness of the issuer of these instruments, including assessments of credit quality and the potential for credit rating downgrades.

Investing in autocalls entails various risks. Here we assess pertinent risks, particularly those linked to the underlying assets.

Potential loss of principal: Other than market-linked notes and deposits, structured investments differ from ordinary debt securities in that the issuer does not guarantee to pay the principal amount of the securities at maturity and may not pay any interest on the securities. Instead, at maturity, investors receive an amount in cash based on the performance of the underlying asset. This amount can be significantly less than the principal amount.

Market risk: When the underlying crypto asset price falls and the knock-in price is breached, investors will lose part of their initial capital as if they own the underlying crypto asset at a higher cost instead of being paid the principal amount. Investors will be paid the coupon before the last observation date of the autocall, but once that date is reached investors get the coupon plus the underlying at the predetermined strike price. In many cases, the risk is that the coupon payments will not offset the loss from the decline of the underlying crypto asset. Hence autocalls are good if the price of the underlying crypto asset performs within a narrow range before maturity, i.e., a short volatility strategy. Autocalls' risk profile exhibits capped upside and potential downside of losing part of the initial capital.

Issuer credit risk: Acquiring an autocall, akin to purchasing a bond, constitutes a form of lending capital. In this lending arrangement, there exists a fundamental concern regarding the potential insolvency of the autocall issuer, which poses a risk of non-repayment, potentially resulting in the loss of invested funds. Notably, all payments associated with autocalls are contingent upon the credit risk associated with the relevant issuer. Autocalls are issued as senior, unsecured debt instruments by the issuer, and fluctuations in the issuer's credit ratings and credit spreads can adversely affect the market value of these structured investments. In the event of a default by the issuer, investors face the potential jeopardy of losing a portion or the entirety of their invested capital. Furthermore, crypto-linked autocalls do not hold the status of bank deposits and, therefore, do not benefit from insurance coverage by entities such as the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Nor do they represent obligations of a bank or come with guarantees from financial institutions.

Liquidity risk: There may be little or no secondary market for crypto-linked autocalls and investors should be prepared to hold the investments until maturity. Autocalls are generally not listed on any securities exchange and their only source of liquidity is from issuers and a limited number of crypto brokers. Even if there is a secondary market for crypto-linked autocalls, it may not provide enough liquidity. If at any time such broker dealer were not to make a market in autocalls, it is likely that there would be no secondary market.

Model risk: Financial losses or inaccurate valuations may result from the use of imperfect or inappropriate mathematical models to value and hedge complex or non-standard financial instruments. Autocalls have non-linear payoffs and path-dependent features, making them more challenging to model accurately. Model assumptions, lack of historical data, illiquidity of market conditions, mis-calibration, and parameter mis-estimation are some of the drivers of model risk for an autocall.

Autocall Pricing

The price of autocalls is equal to the total present value of the expected future cashflows (Exhibit 8).

Exhibit 8: Stylized Final Payoff of an Autocall

To calculate the expected future cashflows, we start by computing the undiscounted conditional probabilities of receiving the coupons. These probabilities are then multiplied by the coupons and discounted. The first coupon is a classical European digital. All coupons that follow are conditional on not autocalling at any previous observation dates. As time goes by, the probabilities of coupons being paid decrease. The value of the last path-dependent coupons can therefore be very small. Here, we price the autocalls using Monte Carlo simulations.

Exhibit 9: Stylized Price Outcomes of Autocalls

Exhibit 9 shows the stylized scenario paths as time passes toward maturity:

Scenario 1 (such as A, B, C): When the underlying’s price increases beyond the knock-out barrier, investors receive their initial capital and the coupon payment. They will have benefited from the rise of the markets within the limit of the coupon. If underlying’s price exceeds the knock-out barrier at a certain observation date, the autocall gets redeemed early.

Scenario 2: The underlying’s price falls but does not break the knock-in barrier at maturity. Investors receive the nominal amount, i.e., investors suffer no loss even as the underlying’s price has fallen.

Scenario 3 (such as D): The underlying’s price drops below the knock-in barrier. Investors lose part of their initial capital. The autocall’s payoff is proportional to the underlying’s market price level relative to the strike price.

A fundamental concept in derivatives pricing is the risk-neutral measure. A market is complete if and only if there exists a unique risk-neutral measure. Yet, under the Heston model, since the number of tradable asset ($S_{t}$) is less than the number of Weiner process ($W_{1,t}$ and $W_{2,t}$), the market cannot be complete. There is no unique risk-free measure. Any of the risk-free measures may be used to price an autocall, but it is likely that each of them will give a different price. Here, we discounted the payoffs using risk-free rate.

Let's assume that an autocall linked to bitcoin (BTC) as the underlying has a maturity of 3 months and monthly observations:

notional = $1,000

strike price = $40,000

coupon rate = 35% per annum

knock-out barrier = 100%

knock-in barrier = 70%

coupon barrier = 70%

$\mu$ = 0.5 (annual return of BTC)

$r_{f}$ = 0.02 (risk-free rate)

$v_{0}$ = 0.8 (initialized annual variance of BTC)

$\theta$ = 0.8 (mean level of variance)

$\sigma$ = 0.5 (volatility of variance)

$\kappa$ = 0.5 (reversion rate of Heston model)

$\rho$ = 0.3 (correlation between Brownian motions)

Based on the Monte-Carlo simulation shown in the Technical Appendix below, we present the following results based on 500,000 simulations. Next, we carry out the sensitivity analysis of an autocall note.

Autocall’s Price to Spot Price

Exhibit 10 illustrates a positive relationship between the price of an autocallable financial instrument and the price of the underlying asset, albeit within a specific range delineated by the knock-in and knock-out barriers. In other words, the price of the autocallable instrument tends to increase as the underlying asset's price surpasses the knock-in barrier. However, as the spot price approaches and surpasses the knock-out barrier, the price of the autocallable instrument may decrease, although this reduction tends to be limited.

Exhibit 10: Autocall Price vs. Spot Price

To provide a more intuitive perspective, let us consider two pricing scenarios, assuming we are one day away from the first observation date:

If the spot price of the underlying asset is USD39,000, it is highly probable that investors will not experience early redemption. Consequently, they not only receive a coupon on the first observation date but also anticipate receiving another coupon on the second observation date. In this context, the autocallable instrument should have a minimum value of USD1,058.

Conversely, if the spot price of the underlying asset is USD41,000, it is highly likely that investors will encounter early redemption, resulting in the receipt of only one coupon on the first observation date. Accordingly, the autocallable instrument's estimated value should be approximately USD1,029.

The dynamics of autocallable instrument pricing are characterized by a decrease in price as the spot price of the underlying asset approaches the knock-in barrier. This is attributed to the heightened risk of experiencing an autocall event at a financial loss. As the spot price nears the knock-out barrier, price reduction occurs, albeit for a different reason. In this case, it stems from the fact that while such an event would lead to a gain, it would also foreclose the possibility of realizing future gains from the autocallable instrument. As time progresses toward maturity (t), the relationship between price and spot price transitions from the blue line to the green line on the graph.

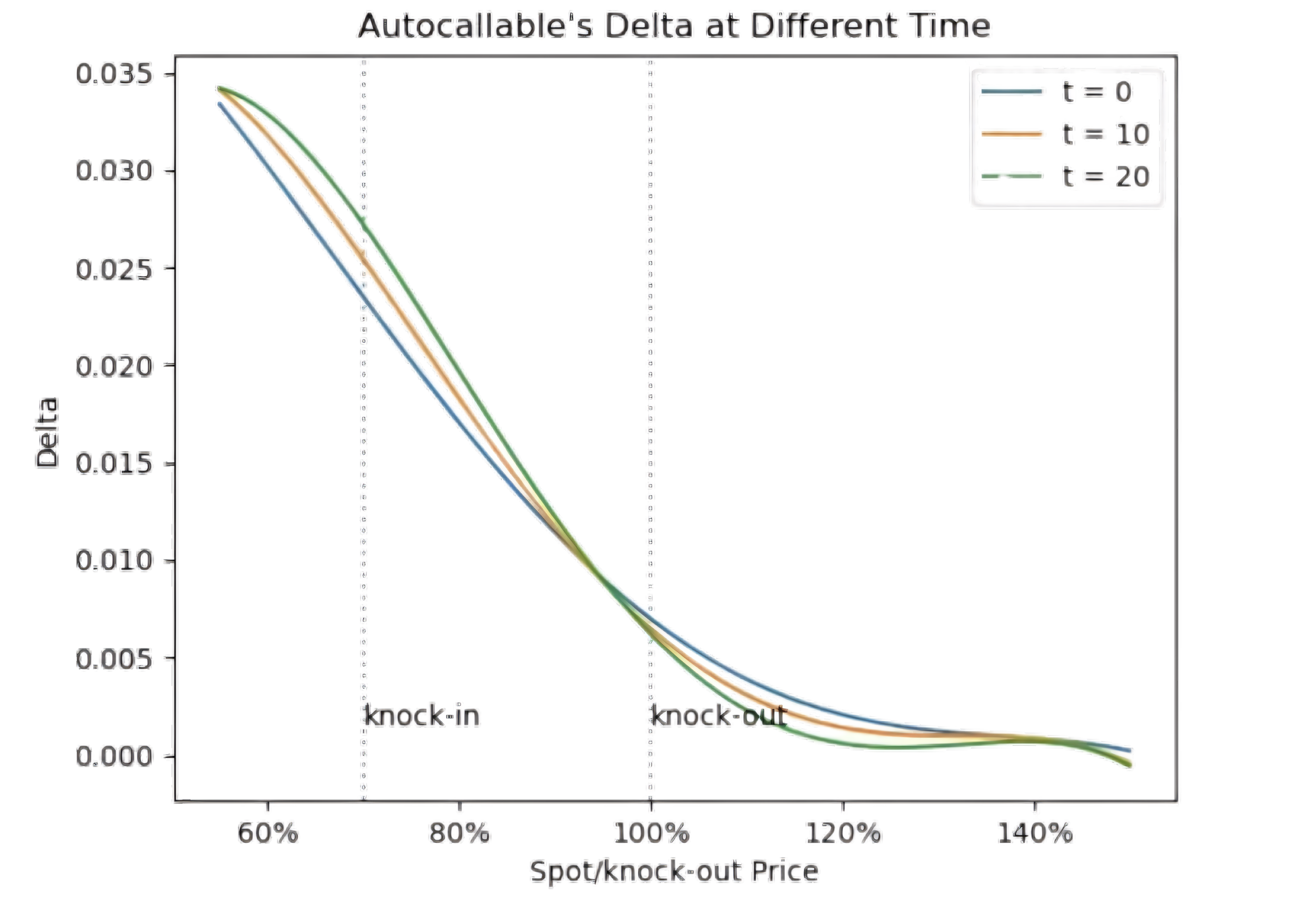

Autocall’s Delta to Spot Price

Exhibit 11 illustrates the relationship between the delta of an autocall and the spot price of the underlying asset, i.e., the autocall’s price sensitivity with respect to the price of the underlying. The delta is predominantly positive, albeit diminishing as the underlying spot price increases. The autocall price increases at a decreasing rate as the underlying price approaches the knock-out barrier, and then levels out as the spot prices move past the knock-out barrier.

Exhibit 11: Autocall Delta

When we are at 1 day before the first observation date, and spot price goes from USD39,000 to USD41,000, the delta can even be negative as the autocall price goes from USD1,058 to USD1,029. As time t increases toward maturity, the delta relationship moves from the blue line to the green line.

Autocall’s Gamma to Spot Price

Exhibit 12: Autocall Gamma

The gamma is the delta sensitivity with respect to the underlying’s prices and represents the slope of the lines on the previous graph of delta relationship. Exhibit 12 shows the relationship between an autocall’s gamma and the underlying spot prices. The gamma exhibits extreme behavior when the underlying spot prices are near the strike price and close to the time to maturity as the time increases.

Autocall’s Price to Volatility

Exhibit 13: Autocall Price vs Volatility

An autocall’s prices are negatively correlated with the underlying’s volatility (Exhibit 13). A seller or a dealer of an autocallable is short the underlying's forward and short the skew. The position in volatility depends on the relative position of the forward price of the underlying with respect to the coupon barrier level.

Exhibit 14: Autocall Vega

The vega is the autocall’s price sensitivity with respect to the underlying’s volatility and is mostly negative (Exhibit 14). The overall vega is split over the observation dates to form vega buckets, as illustrated in Exhibit 14. Each of these vega sensitivities will change as the market moves. The magnitude of the vega is decreasing as the time increases toward maturity. The vega will go to zero when the underlying’s prices go up as the probability of autocalling increases. Vega hedge will therefore be dynamic and readjusted depending on the evolution of the underlying asset. Specifically, if the spot goes down, the volatility that a dealer needs to hedge is going to change. Initially, when the spot moves down it involves selling shorter-dated volatility and then when it goes further down the dealer starts to buy longer-dated volatility back. For crypto-linked autocalls, the lack of liquidity beyond six-month options expiry limits dealers’ ability to effectively hedging out risk.

Autocall’s Redemption Rate

Exhibit 15: Autocall Redemption Rate

Exhibit 15 shows the proportion of redemptions at each observation date based on our example. More than 50% of investors got knocked-out on the first observation date. About 12% of investors got knocked-in and experienced partial loss of their initial capital.

Conclusion

We have discussed various crypto-linked autocalls in the context of current market conditions. These structured notes can be instrumental in fostering market maturation and adoption by providing risk management, customization, diversification, income generation, and increased market participation. They can also help stabilize markets, enhance regulatory compliance, offer hedging and arbitrage opportunities, and contribute to market education. These structured products contribute to the development and evolution of cryptocurrency capital markets by offering new ways for investors to participate in and benefit from these markets.

Technical Appendix

Explanation of the Heston Model

The Heston model is a widely used stochastic volatility model in quantitative finance to describe the dynamics of asset prices, particularly in the context of options pricing and risk management. Developed by Steven Heston in 1993, the model addresses one of the shortcomings of the Black-Scholes model by incorporating stochastic volatility into the price dynamics of an underlying asset.

Background

The Black-Scholes model, although revolutionary in its time, assumes constant volatility of the underlying asset. However, empirical evidence suggests that volatility is not constant and can vary over time. The Heston model aims to capture this volatility variation by introducing a stochastic process for volatility itself.

Model Components

The Heston model consists of two stochastic differential equations (SDEs) that describe the evolution of the underlying asset price and its volatility over time:

$S_t$ is the asset price at time at $t$.

$v_t$ is the instantaneous variance (volatility squared) of the asset price at time at $t$.

$\mu$ is the drift of the asset price.

$\theta$ is the long-term average of the variance.

$\kappa$ is the rate at which $v_t$ reverts to its long-term average $\theta$.

$\frac{\sigma}{\sqrt{v_t}}$ is the volatility of variance.

$W_{1,t}$ and $W_{2,t}$ are two Wiener processes with the correlation $\rho$.

The Heston model introduces several key aspects:

The asset price is influenced by its own volatility through the term $\sqrt{v_t}$, reflecting the fact that higher volatility leads to larger price movements.

The variance $v_t$ follows a mean-reverting diffusion (CIR like process) toward its long-term average $\theta$ over time with a speed determined by $\kappa$.

The volatility of variance, represented by $\frac{\sigma}{\sqrt{v_t}}$, controls how much $v_t$ fluctuates over time. This term ensures that the volatility of the asset can vary around its mean over time.

Captures the volatility smile/smirk observed in the derivatives market, where options with different strikes but the same maturity have varying implied volatilities.

Allows for the modeling of market phenomena such as volatility clustering and the leverage effect.

Monte Carlo Simulation

In general, an autocall’s price is the present value of the sum of the coupons if received without early redemption and the principal notion proportional to the underlying’s market price level or the worst-of performance of the underlying asset basket relative to the strike price if underlying’s price falls below the strike price, as described below:

The pseudo code can be written as:

Let $N$ be the number of simulations.

For $i$ in $1:N$, we use Heston model to simulate a price path from $0$ to $T$.

For each path $N$, at predetermined valuation dates, calculate the payoff of the autocall based on this price path.

Price of the autocall is the mean of discounted payoffs of each simulated path.

Contributed by Ruichang (Richard) Zhu – Quantitative Trading Intern

A dedicated Quantitative Trading Intern with a robust academic background in mathematics and option pricing, Ruichang is currently pursuing his Master of Arts in Mathematics of Finance at Columbia University while working as a quantitative Trading Intern at Samara Alpha Management. He is passionate about applying cutting-edge stochastic differential equation (SDE) and machine learning algorithms in derivatives pricing and risk management.

[1] All reference to prices and coupon payment amounts are hypothetical and for education and illustration purposes.