Scenario Analysis in Crypto Trading

How digital asset traders and portfolio managers use stress testing, a form of scenario analysis, in a market that demands a strong risk management approach.

Sep 16, 2024Digital asset traders know that, despite market maturation and a regulatory framework slowly taking shape, they’re still operating in a highly volatile asset class, and one in which the number of currencies, trading venues, and trading instruments is continuously evolving. This volatility can be beneficial, with some trading strategies performing well in highly volatile environments. It can also be costly when extreme declines occur, which they have, over this market’s relatively short life span.

As traders and portfolio managers continue to build out digital asset portfolios, access to reliable data and analytics is a critical starting point for managing portfolio risk. Scenario analysis is a tool used by sophisticated investors to determine the potential impact of a market event on their portfolios. In this article, we focus on stress stressing – a type of scenario analysis that has long been used by traditional asset managers to test the resilience of a portfolio – to better understand how it can guide decisions in the digital asset market.

Scenario Analysis

Scenario analysis is the process of estimating or predicting how a portfolio might perform under certain conditions.

A Brief Overview

Scenario analysis highlights the “what ifs” to the portfolio in terms of relevant market event risks, considers the range of potential outcomes around those risks, then analyzes the hypothetical impact on the portfolio. From there, traders can determine if the potential level of upside or downside makes sense for their approach and risk tolerance. Both likely and unlikely events can be tested, such as:

What if interest rates spike 3% in six months?

What if the S&P declines by 50% in the next 12 months?

What if a major centralized cryptocurrency exchange collapses?

What if a global stablecoin depegs?

Incorrect or biased assumptions can make for models that just aren’t useful. For portfolio managers and traders to be most efficient and effective, they require access to data and analytics that are fast, reliable, and undoubtedly integrated with their portfolios.

Portfolio Management

Applying forward-looking insights to the macroeconomic environment enables an investment manager to think about a broad expanse of hypothetical investment outcomes in the future. It may not always provide the final portfolio decision, but it surfaces important insights and makes the process more transparent along the way.

Whether applying this tool to traditional markets like equities, or evolving ones like digital assets, the process looks the same:

The first step in building a scenario is to define the portfolio to be assessed. Next, we identify scenarios, or market events, of which to get ahead. These can focus on things like macroeconomic regimes, geopolitical risks, or policy events. We then shock the portfolio and analyze the results to determine potential implications.

Applying Scenario Analysis—The Importance of Stress Testing

In the ever-evolving digital asset market, stress testing stands out as an essential tool for managing risk. Unlike traditional financial markets, where significant black swan events occur intermittently—such as the Great Financial Crisis in 2008 or the dot-com bubble burst—the digital asset market has been characterized by a higher frequency of similarly extreme events. This heightened volatility, coupled with the still speculative nature of these assets, results in the risk of exaggerated price reactions to both positive and negative market developments.

In this context, stress testing becomes crucial for assessing the resiliency of a portfolio.

Stress testing, a focused method of scenario analysis, examines how a portfolio would perform under severe financial conditions, encompassing both negative and positive shocks. This process enables portfolio managers to:

Gauge reactions to extreme market events;

Identify vulnerable assets; and

Implement effective hedging strategies.

Historically, performing detailed stress testing on digital asset portfolios was challenging due to limited tools and data. However, with advancements in technology, portfolio managers now have access to sophisticated tools that provide realistic and timely risk assessments. As the digital asset market continues to expand and macroeconomic uncertainties persist, integrating stress testing into portfolio management practices becomes important for managing risk in and better navigating the complexities of the digital asset market.

Stress Testing in Action

To illustrate the process, we will use the historical stress testing capabilities found on the Sylvanus Technologies platform.[1] Historical stress testing is a method of stress testing that uses past events to assess how a portfolio might respond to similar market conditions in the future.

Define the Portfolio

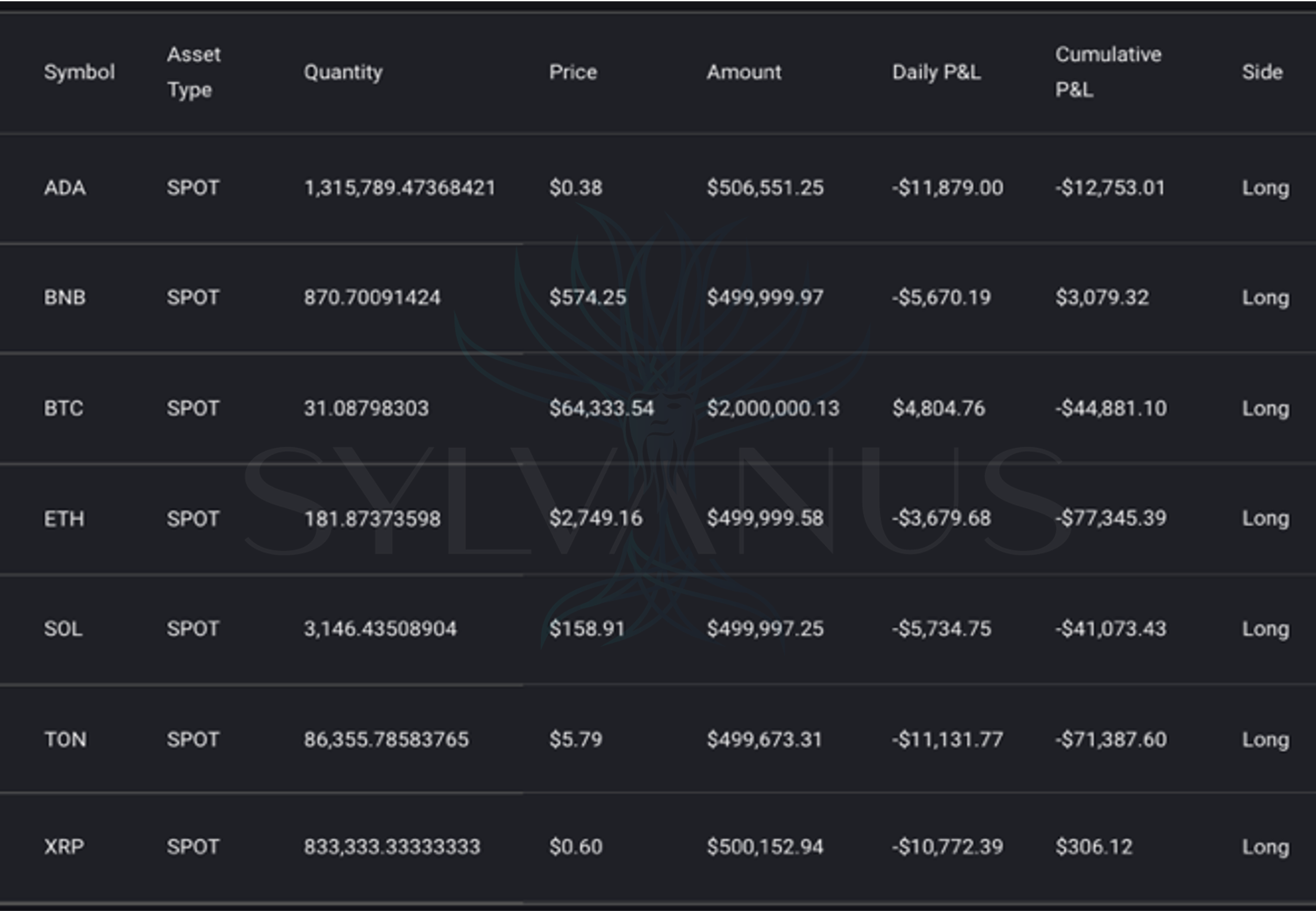

In our example, the selected portfolio to be shocked is a $5 million portfolio of cryptocurrency tokens comprising:

$2 million in bitcoin (BTC)

\$3 million split between six altcoins, aiming for a beginning balance of approximately $500,000 in each: Cardano (ADA); Binance Coin (BNB); Ether (ETH); Solana (SOL); Toncoin (TON); and Ripple (XRP)

The beginning balance of our sample portfolio is as follows:

Source: Sylvanus Technologies and Samara Asset Management. Values as of August 25, 2024.

Identify the market event

In our example, we will analyze the effects of the following events:

Black Monday I of the 2020 COVID-19 stock market crash (bear market event)

The collapse of cryptocurrency exchange FTX (bear market event)

The launch of spot bitcoin ETFs in the United States (bull market event)

Each scenario in our example is a significant historic market event, either specific to the cryptocurrency market, or a broader macroeconomic shock. Each scenario is defined by the specific date range during which the market was most impacted.

Shock the portfolio

In our stress test, the factor to be shocked is the market price of each cryptocurrency asset in the portfolio.

Portfolio impact

In our example, we use the drawdown to look at portfolio losses following an adverse event and examine the portfolio’s period return to assess gains following positive market developments.

Bear Scenario

To evaluate potential portfolio losses during an adverse event, we consider what the short-term worst-case scenario would look like for the portfolio. We applied a shock by taking the largest daily drawdown of each token within the specified date range and simultaneously imposing these losses across all assets in the portfolio on the chosen date. The result is illustrated in the chart below.

Portfolio drawdowns under pre-defined bear-market scenarios

Source: Sylvanus Technologies and Samara Alpha Management.

Bull Scenario

To assess how the portfolio might react to positive market developments, we evaluate the portfolio's gains or losses over the defined date range. Our model examines the change in the token's price from the beginning to the end of this period and applies the corresponding percentage change to each token in the portfolio, as illustrated in the following chart:

Portfolio returns under pre-defined bull-market scenarios

Source: Sylvanus Technologies and Samara Alpha Management

Understanding Potential Limitations

Stress testing is a guiding tool and, like with other tools, limitations should be understood. Some considerations include the following:

The selection of date ranges for stress testing is not precise and can be subjective. The chosen dates may not fully capture the impact of extended losses.

Significant losses can occur over a long period of time without significant daily drawdowns.

Factors beyond the event being shocked may affect the market during the selected date ranges, potentially influencing the outcomes.

Stress Testing in Action…

Applying the stress testing capability to the three scenarios outlined above, we can visualize hypothetical portfolio impacts.

Black Monday I

March 9, 2020, known as Black Monday I of the COVID-19 stock market crash, marked the beginning of a severe downturn in global equity markets. Triggered by mounting fears over the rapid spread of COVID-19 and its economic impact, the S&P 500 dropped by 7.6% on this day alone. This decline was part of a broader market sell-off, which saw substantial losses across major indices as investors reacted to the escalating uncertainty and potential global economic disruption.

Digital assets also faced significant losses, with many of these losses occurring over the weekend leading up to Black Monday I. Specifically, from Saturday, March 7 (00:00 UTC), through Monday, March 9 (00:00 UTC March 10), bitcoin declined by approximately 11% and ether by 15.5%, mirroring the broader market turmoil.

Here is how our sample portfolio would have performed in the period leading up to Black Monday I:

Source: Sylvanus Technologies and Samara Alpha Management. Date range of scenario: February 29, 2020–March 09, 2020.

FTX Collapse

The infamous collapse of cryptocurrency exchange, FTX, in November 2022 was a pivotal moment in the digital asset market. FTX’s downfall was the result of a liquidity crisis at the exchange, triggered by a sudden surge in withdrawal requests following revelations of financial mismanagement and close ties to sister company, Alameda Research. This led to a dramatic loss of confidence in centralized exchanges and double-digit declines across cryptocurrencies in the days that followed.

Our sample portfolio would have experienced significant losses:

Source: Sylvanus Technologies and Samara Alpha Management. Date range of scenario: October 31, 2022–November 10, 2022.

U.S. Spot Bitcoin ETF Launch

The approval and launch of U.S. spot bitcoin ETFs marked a significant milestone for the digital asset industry, improving access to bitcoin and signaling the potential for a more favorable regulatory environment for digital assets in the U.S. The ETFs were approved by the SEC on January 10, 2024, and began trading the following day. Trading volumes and inflows surged, and the cryptocurrency market rallied, continuing an upward trend in the months that followed.

Consistent with the cryptocurrency market, our sample portfolio would have generated strong results:

Source: Sylvanus Technologies and Samara Alpha Management. Date range of scenario: January 9, 2024–March 13, 2024.

Building Resilience Through Stress Testing

As the digital asset market evolves, portfolio managers and traders must equip themselves with robust risk management tools to navigate the inherent volatility. Stress testing is not merely an exercise in understanding potential losses, but a proactive approach to managing uncertainty. By systematically assessing the impact of both positive and negative market shocks, digital asset managers can identify vulnerabilities, adjust their strategies, and build more resilient portfolios.

In a market where extreme events tend to happen more frequently than in traditional asset classes, scenario analysis is essential for ensuring that portfolios can withstand the unexpected. While no model can fully predict the future, incorporating stress testing into a risk management framework empowers managers to make informed decisions, adapt to changing market conditions, and position themselves for long-term success in the rapidly evolving world of digital assets.

[1] Sylvanus is a digital asset portfolio monitoring and risk management platform built by traders for traders and asset managers. To learn more about integrating the full suite of Sylvanus’ capabilities or to schedule a demo, please visit their website or email info@sylvanus.io.